- Blog

- How to Import a Car to Poland

How to Import a Car to Poland

Discover how to import cars to Poland from the EU in this step-by-step guide for traders. Learn about regulations, taxes, and processes to maximize profits in the Polish market.

Are you a car trader looking to expand your business by importing vehicles from the EU to Poland?

This guide will walk you through the process, covering everything from understanding the Polish used car market to the step-by-step import procedure.

Importing cars can be a profitable venture, but it requires knowledge of the market, regulations, and procedures. We'll break down each aspect to help you navigate this process smoothly and efficiently.

Get to know the Polish used car market

The Polish used car market is a significant sector of the country's automotive industry, with imported vehicles playing a major role.

Approximately 736,000 used cars were imported to Poland in 2023. This marks a slight decrease from previous years, likely due to economic factors and changing regulations.

eCarsTrade bietet Online-Autoauktionen von Ex-Leasingfahrzeugen aus Europa!

The average age of imported used cars in Poland is around 13 years. This figure has been gradually increasing, reflecting a trend towards older vehicle imports.

Germany remains the primary source of imported used cars, followed by France, Belgium and the Netherlands.

Diesel vehicles are regaining popularity in Poland. Meanwhile, falling new EV prices are impacting the used-car market, forcing significant discounts on 2-3 year-old models and causing a rapid decline in their value over recent months.

In terms of brands, Volkswagen is the most popular brand among imported used cars, but Audi A4 is the most popular car model.

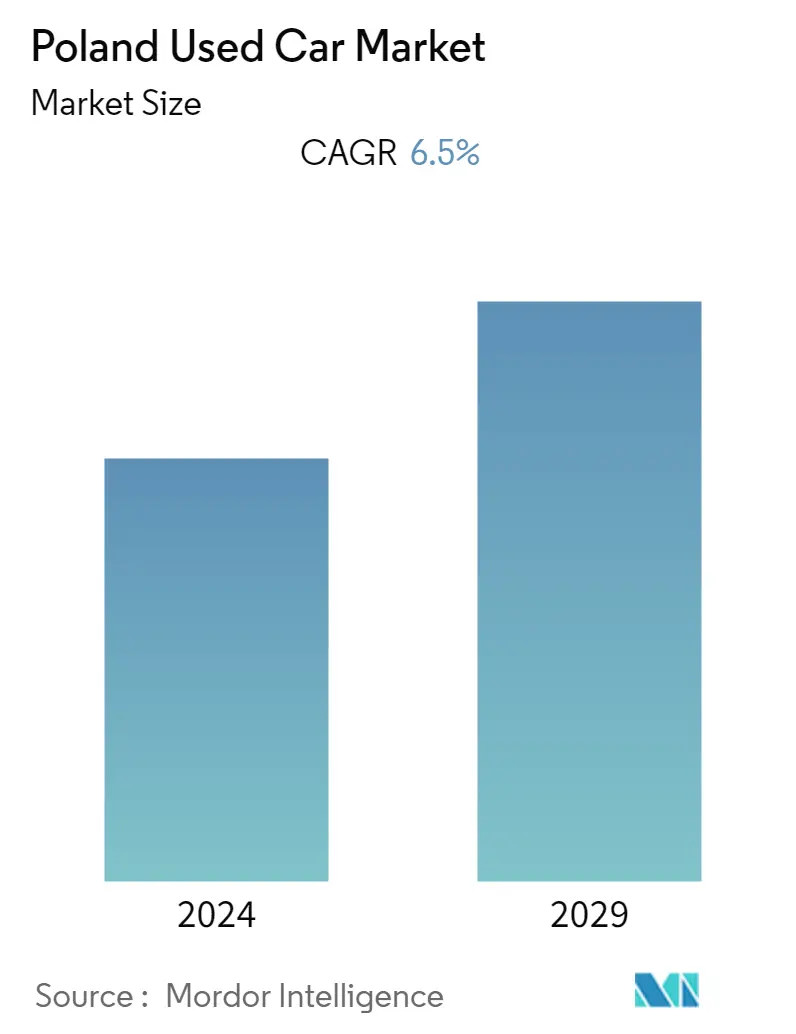

Source: Mordor Intelligence

The total value of the used car market in Poland was estimated at approximately about 18 billion EUR in 2021 and is expected to grow to 28 billion EUR by 2027.

Documentation required for car import to Poland

As a car trader importing vehicles to Poland, you'll need to navigate necessary paperwork for a smooth import process.

-

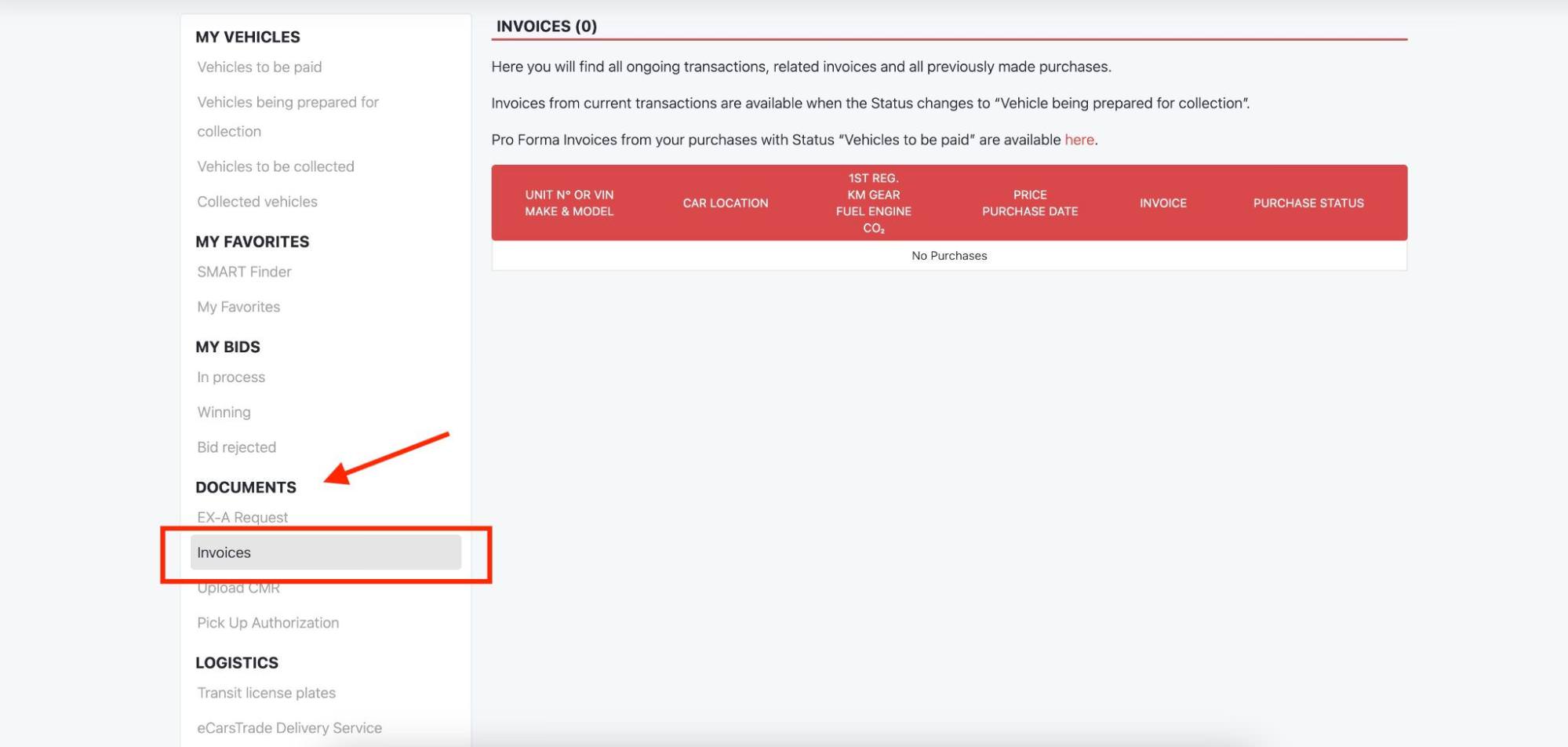

Vehicle purchase invoice

The purchase invoice is the foundation of your import documentation. It must clearly show your business details as the buyer, the seller's information, vehicle details and the purchase price.

You will receive your purchase invoice via email and you can always access it through your Personal page.

-

Certificate of Conformity (COC)

The COC is a crucial document that proves the vehicle meets EU standards. It's typically issued by the vehicle manufacturer and it’s important for the registration process.

In our experience, not all cars sold on eCarsTrade will come with a COC. it often depends on which country the car is coming from. For example, cars from France will rarely come with a COC.

-

Vehicle registration documents

When you buy a car through us, we always provide the original registration documents. We're flexible about how you get them - you can collect them along with the car, or we can mail them wherever you'd like.

Just remember, you'll need to have all these papers translated into Polish. Make sure to use an officially recognized translator for this step - it's important to get it right for the authorities.

-

Proof of insurance

You'll need valid insurance coverage for two stages: transit insurance and temporary Polish insurance. Transit insurance covers the vehicle during transport to Poland, while temporary Polish insurance is required once the vehicle enters Poland, even before registration. Many traders opt for a comprehensive policy that covers both transit and the initial period in Poland.

-

Customs declaration

In order to successfully register the car, you will first need to clear customs. Clearing customs involved paying excise duty, VAT and a customs fee.

-

Technical inspection certificate

Having a recent technical inspection certificate from the country of origin is essential for the registration process in Poland.

-

Translation of documents

Any original car documents not in Polish need to be translated by a sworn translator in Poland. This includes the vehicle registration certificate, technical inspection reports, and any other supporting documents in foreign languages.

Taxes, fees, and VAT

The main taxes and fees you'll encounter when importing a car to Poland are:

1. VAT (Value Added Tax): As a trader, you'll typically pay net prices when purchasing vehicles, and then you must pay and declare VAT in Poland. The standard VAT rate in Poland is 23%, and it’s calculated on the total value of the imported vehicle, including the purchase price and transportation costs.

2. Excise duty: Excise duty is another significant tax that applies to all imported passenger cars to Poland. The rates vary based on engine size, fuel type, and CO2 emissions.

3. Registration fee: You must pay a registration fee to register an imported vehicle in Poland. It consists of a base fee for the registration card and vehicle plates, additional fees for temporary plates if needed, and charges for mandatory vehicle inspection

4. Customs fee: The rate can vary but is typically around 10% of the vehicle's value.

For more information, read our full guide to Polish car taxes and the taxation system.

Step-by-step process - from purchasing a car to importing it to Poland

1. Research and purchase the vehicle

Find the right cars for your inventory in eCarsTrade auctions, Fixed prices or Our Stock and complete the purchase! You will receive all available documentation from us, including the original registration documents.

2. Prepare for transport

After purchasing, arrange for the vehicle to be transported to Poland. You have several options:

- Let eCarsTrade organize the delivery for you

- Hire a professional car transport company yourself

- Drive the car yourself with temporary transit license plates

Whichever method you choose, ensure the vehicle is properly insured for transit.

3. Gather all necessary documentation

Before the car arrives in Poland, make sure you have these documents:

- Original purchase invoice

- Vehicle registration documents from the country of origin

- Certificate of Conformity (COC)

- Proof of insurance

- Any other relevant paperwork (like service history or previous technical inspections)

What to do if you haven’t received a Certificate of Conformity with your car?

This is not an unusual situation on eCarsTrade, especially with French cars who almost never come with a COC.

But don’t worry, obtaining a COC even if the car didn’t come with one is really easy.

You have two options:

1) You can ask the brand of the vehicle directly, and they could provide it either for free or for a certain price

2) Use an online service like EuroCOC to quickly and easily obtain a COC

4. Translate your original vehicle documents into Polish

When you receive your car documents, you'll need to get them translated into Polish by an official translator.

Polish authorities require all documents to be in Polish when you're registering a vehicle.

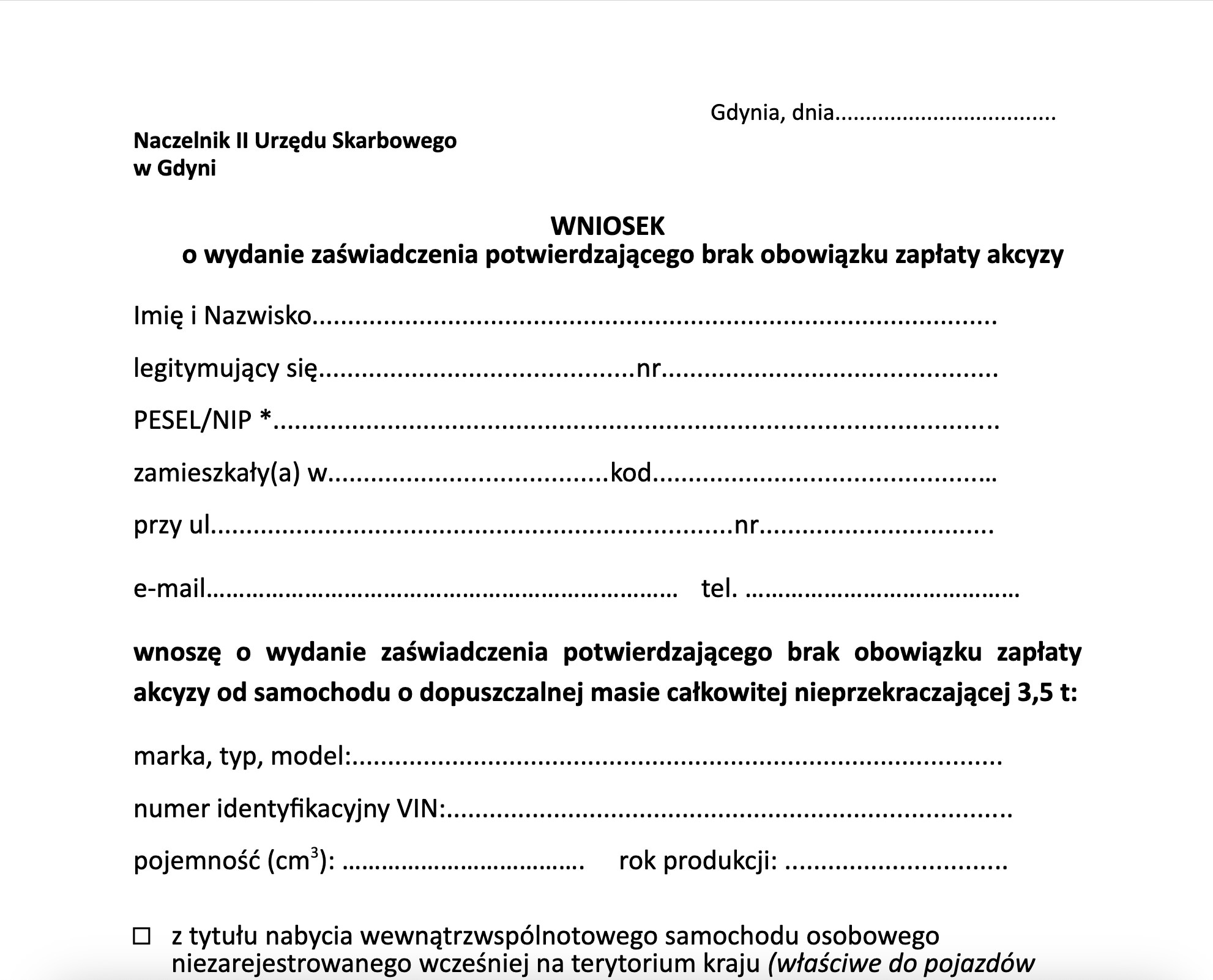

5. Pay the excise duty

When the vehicle arrives to Poland, you'll need to clear customs. This involves:

Visit the local customs office to sort this out. You can figure out where your nearest customs office is by googling “Urząd celny” and your area.

How much you pay for the excise duty depends on things like how powerful your car is, what kind of fuel it uses, and how old it is. These factors will determine the percentage of the purchase price you will need to pay as excise duty.

After that, you will need to fill out the AKC-U/S declaration. If you’re importing an electric car, you are not obliged to pay excise duty, and you can apply for an exemption.

You have 14 days after the car crosses into Poland to submit the AKC-U/S declaration to Customs.

One last thing to keep in mind as you’re going through this step - there is also a Customs fee, calculated at 10% of the purchase price of the car.

Example of a AKC-U/S declaration

Example of a AKC-U/S declaration

6. Pay VAT

While you’re at your local customs office, you can also pay 23% VAT on the purchase price of the car.

7. Technical inspection

To register a vehicle in Poland, you will need a technical inspection certificate.

Take the vehicle for a technical inspection at any authorized station in Poland. This inspection ensures the car meets Polish road safety standards.

8. Insure the car

Obtain compulsory third party liability insurance. You will need to present a proof of insurance during the registration process.

Alternatively, you can opt for a short-term civil liability insurance, if you plan to sell the car immediately once it is in Poland. This gives you about four weeks to finish the registration process.

9. Register the car

Now you have everything you need to register you vehicle!

Make an appointment with your local Transport Office - Wydział Komunikacji i Transportu Starostwa Powiatowego.

Go to the Transport Office with all the documents you have gathered so far:

- ID card

- Original documents legally translated to Polish

- Proof of paid taxes

- Technical inspection certificate

- Proof of insurance

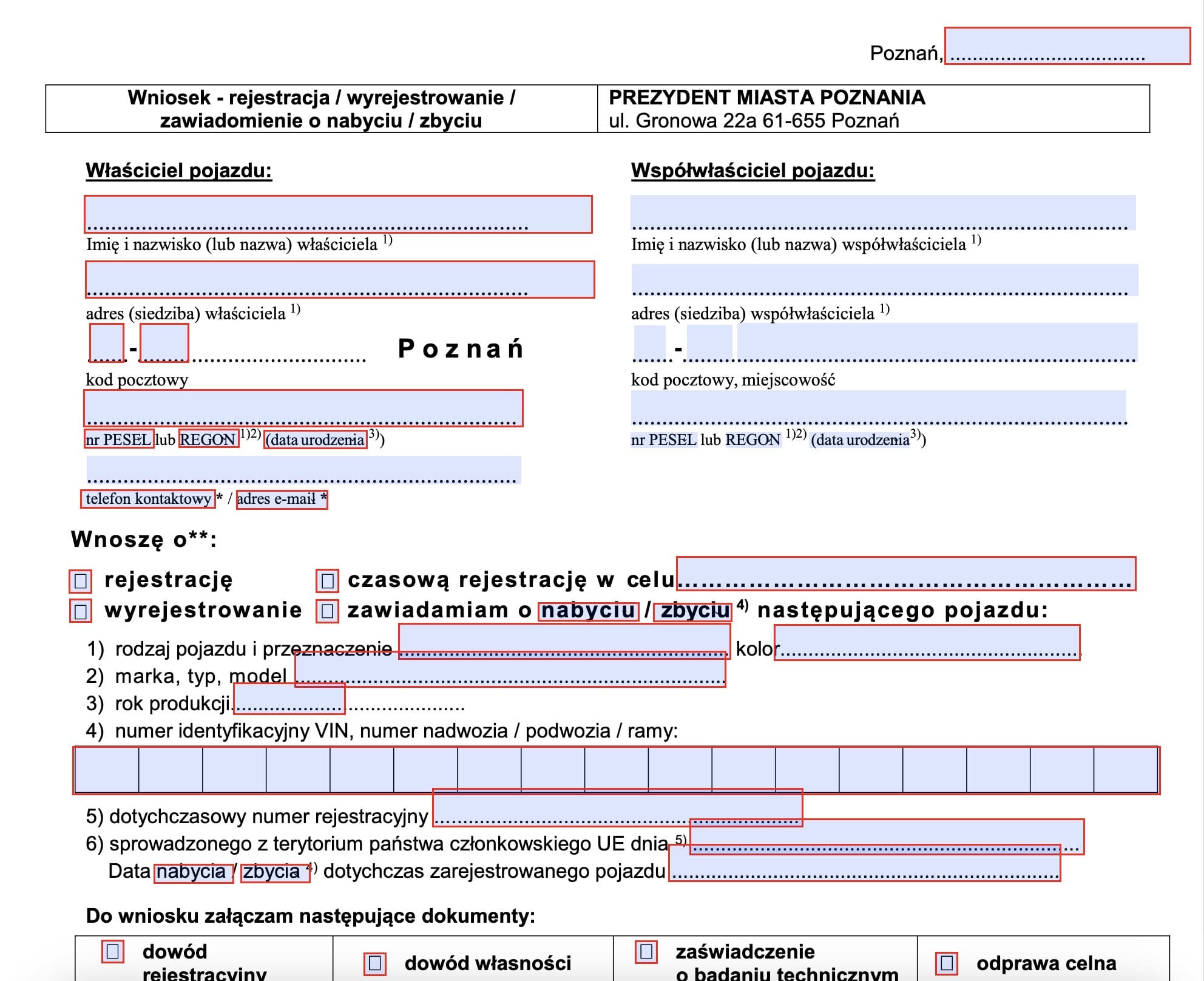

- Application for registration

Example of a registration application

Example of a registration application

They'll process your application and issue a Polish vehicle card (dowód rejestracyjny) and permanent license plates.

10. Obtain Polish license plates

Once you receive the permanent plates, attach them to the vehicle. And voila, you have successfully imported a car into Poland!

Importing a Car to Poland - FAQ

► How long does the import process usually take?

The duration can vary, but typically it takes between 7 to 14 days from the time the car arrives in Poland. This includes customs clearance, paying taxes, technical inspection, and registration. Of course, delays can always occur for various reasons, so always keep that possibility in mind.

► Do I need to be present for the entire import process?

As a trader, you can often delegate parts of the process to authorized representatives or customs agents. However, your presence might be required for certain steps, like signing official documents. Many traders find it beneficial to oversee the process personally, at least for their first few imports.

► How do I calculate the total cost of importing a car?

Consider the following costs:

- Purchase price of the vehicle

- Transport costs to Poland

- Customs clearance fees (if using an agent)

- VAT (23% of the vehicle's value plus transport costs)

- Excise duty (varies based on engine size and type)

- Registration fees

- Technical inspection costs

The exact amount will depend on the specific vehicle and current rates.

► Are there any tax advantages for importing newer or electric vehicles?

Yes, Poland offers some incentives for importing newer, more environmentally friendly vehicles. Electric and hybrid vehicles often have lower excise duties.

All you need to know about car import to Poland

We hope this article on how to import cars from the EU to Poland motivated you to expand your inventory by sourcing cars internationally.

As you gain experience, you'll develop valuable skills in spotting good deals and streamlining the import process.

Stay informed about changing regulations and market trends, and don't underestimate the value of building strong relationships with suppliers, local authorities, and specialized import agencies.

We’re sure you will turn car importing into a rewarding and profitable venture in Poland. And remember, eCarsTrade is here to partner with you on this journey!

Our extensive inventory includes various makes and models to suit all your needs, sourced directly from reputable European leasing companies, short-term rental companies and dealerships: